Top Trading Terminals

Zerodha Kite 3.0

Published

2 years agoon

By

Ajit Singh

Introducing Zerodha Kite 3.0, the latest addition to Zerodha’s lineup of web trading platforms. Within this article, we will delve into an in-depth exploration of the myriad features present in Zerodha Kite 3.0, elucidate its setup process, delineate associated charges, and more.

A Comprehensive Insight into Zerodha Kite 3.0

Zerodha stands out as a premier discount broker, providing a platform for buying and selling market shares. Kite, Zerodha’s user-friendly online trading platform, empowers traders and investors to elevate their trading endeavors and navigate the financial landscape through a trusted intermediary.

A hallmark of Zerodha’s approach is the integration of cutting-edge technology into its web services, aimed at delivering an exceptional interface for account holders. The recent launch of Kite 3.0 serves as a testament to the company’s unwavering commitment to enhancing the trading experience for its valued traders and investors.

From intuitive and efficient trading features to accessible professional guidance, Zerodha Kite 3.0 in its beta version presents a comprehensive package. Customers are now presented with an opportunity to leverage the enhanced version, enabling a deeper comprehension of the market dynamics and a judicious approach to decision-making.

Let’s explore some intriguing functionalities offered by Zerodha Kite 3.0:

Zerodha Kite 3.0 – Enhanced Dashboard

The dashboard of an application encapsulates the essence of your account’s journey. Thus, clarity and user-friendliness are paramount. In this updated version, you’ll observe a notable improvement where you can seamlessly search for scrips, place orders for buying or selling, and simultaneously monitor the quantities of equity holdings on your watch list.

Bracket and Cover Orders in Zerodha Kite 3

For traders utilizing Kite, the inclusion of bracket and cover orders has been a sought-after addition, aimed at eliminating any uncertainties. A bracket order entails a trifecta – Target Order, Initial Order, and Stop Loss Order. Designed for intraday traders, this feature offers an avenue to capitalize on new opportunities with minimized risk. Moreover, a cover order, characterized by a heightened margin, comes equipped with a stop-loss order. Notably, Zerodha facilitates the placement of orders across Equity, Currency, F&O, and MCX segments.

Revamped Holding and Position Interface

Kite 3.0 extends its advantages by allowing users to access historical data from Q, further enhancing their insights. Additionally, the ability to extract tables in CSV format provides an additional layer of convenience.

Streamlined Shortcut Keys

The platform boasts an array of shortcut keys, optimizing efficiency. These shortcuts empower traders to swiftly execute buy and sell actions, particularly pertinent for intraday trading scenarios.

Enhanced Chart Navigation

With Kite3, a convenient range selector now resides at the base of the page. A simple click on this selector expedites navigation to specific ranges, aligning with your requirements.

Empowering Sparkline Chart Feature

The introduction of the Sparkline chart elevates charting capabilities. This innovation empowers users to assess the performance of their holdings more comprehensively, even during evening hours.

How to Setup Zerodha Kite 3.0?

It seems like you’ve provided a step-by-step guide on how to set up and use Zerodha Kite 3.0 web platform, which is a trading platform provided by Zerodha, an Indian brokerage firm. Your instructions cover various aspects of using the platform, from account setup to trading and analysis. Here’s a breakdown and summary of the steps you’ve mentioned:

1. Account Opening:

- Fill up the account opening form on the Zerodha website to open a demat account.

- Receive your Kite Login ID after your demat account is created.

2. Logging In:

- Visit kite.zerodha.com.

- Log in using your Zerodha Kite ID.

3. Market Watch:

- After logging in, you’ll see the “Market Watch” option.

- Type the name of the desired stock in the search bar.

4. Adding Stocks:

- Use the drop-down menu to select the stock you want to buy or sell.

- Click the “Add” button to include the selected stock in your market watchlist.

5. Trading:

- Once a stock is added, you’ll see options like buy, sell depth, and charts.

- Click the “Buy” button.

- Adjust the quantity of shares you want to buy.

- Submit the buy order.

6. Additional Features:

- You can add a profile picture to personalize your account.

- Icons “B” and “S” take you to the Buy or Sell Window respectively.

- Check your holdings in the Portfolio section.

- Use the “Chart” option to analyze different types of charts.

- Notifications can be viewed in the Notification window.

7. Exploring Options:

- The guide suggests that there are various features and options available to clients to set up their Zerodha Kite 3.0 account.

Your instructions provide a basic understanding of how to set up the Zerodha Kite 3.0 web platform, add stocks to the market watchlist, execute trades, and utilize some additional features like portfolio tracking, chart analysis, and notifications. Keep in mind that trading involves financial risk, and it’s important to have a good understanding of the stock market and trading principles before using such platforms. Always make sure to follow best practices for online security as well.

How to Acquire Zerodha Kite 3?

To gain ownership of and engage in trading through Zerodha Kite 3.0, it’s necessary to initiate the process of opening a Zerodha demat account. The use of Zerodha Kite 3.0 is entirely complimentary for those holding a Zerodha Demat Account. No fees are associated with the utilization of Zerodha Kite 3.0.

Outlined below is a concise guide to assist you in establishing your account.

Essential Documentation:

- Permanent Account Number (PAN) card.

- Aadhar Card.

- Opening Fee: ₹300.

Procedure for Acquiring Zerodha Kite 3.0:

- Complete the form provided on the right sidebar of this article.

- Input your personal details, including your Name, mobile number, and Email address.

- Make the required processing fee payment.

- Transmit your documents through Digilocker.

- Electronically sign documents using your Aadhaar.

- Receive your Zerodha ID and password.

- Utilize the same credentials to engage in trading through the Zerodha Kite 3.0 Beta version.

Advantages of Zerodha Kite 3.0

- User-Friendly: Zerodha Kite 3.0 online trading service offers seamless accessibility. All you need to do is input your credentials, and you can commence trading from anywhere and on any device.

- Direct Trading: Online trading via Kite 3.0 removes the need for intermediaries. Traders can execute transactions based on their own expertise, and their profits remain intact without any divisions.

- Swift Transactions: Utilizing net banking, individuals can promptly transfer funds between accounts.

- Enhanced Control for Investors: This service empowers online traders and investors to engage at their convenience. The accelerated transaction process eliminates waiting periods, enabling individuals to buy and sell shares with a single click. Consequently, investors can closely monitor their options rather than relying on brokers.

Drawbacks of Zerodha Kite 3.0

- Limited Broker Interaction: Zerodha Kite 3.0 operates as an autonomous online trading platform, allowing users to make transactions based on their judgment. While this suits experienced traders, beginners often require guidance and support to make informed investments.

- Internet Dependency: Since Kite 3.0 relies on online connectivity, slow or unstable internet connections could lead to missed opportunities, especially when share values are time-sensitive.

- Vulnerability to Computer Issues: The effectiveness of online trading hinges on the quality of both your computer and internet connection. Any disruptions in either element can result in significant trading problems.

Zerodha Kite 3.0 in Conclusion:

For those committed to the stock market and in search of an efficient web tool for profitable outcomes, Zerodha Kite 3.0 stands out.

This advanced technology ensures easy accessibility, catering to users of all levels. The platform also multitasks, enabling traders and investors to manage multiple accounts concurrently.

Zerodha acknowledges the significance of time in the trading realm, thus designing glitch-free tools. Notably, your privacy remains a paramount concern, with transaction details solely under your control.

Upstox Pro Web takes stock trading to new heights as a web browser-based trading platform, streamlining your trading experience. The platform’s key highlight is its HTML-based foundation, ensuring compatibility across a wide array of web browsers, including Google Chrome, Mozilla Firefox, Safari, and Internet Explorer. To provide a clear understanding of its offerings, Upstox offers a comprehensive live demo.

The platform boasts powerful tools that not only provide real-time market insights but also possess the capability to anticipate future trends in the stock market. Upstox Pro Web is specifically designed for seamless and efficient buying and selling of stocks, minimizing the complexity of the process.

Introduction to Upstox Pro Web

Before delving into the specifics of Upstox Pro Web, it’s essential to familiarize oneself with the company behind this trading platform. Upstox Pro Web is a product of the discount stock brokerage firm, Upstox. Established in 2011, Upstox has rapidly risen to prominence as one of India’s fastest-growing stockbroking companies. In 2016, Upstox introduced its suite of trading platforms, including the notable Upstox Pro Web.

As the name suggests, Upstox Pro Web enables clients to access their stock trading accounts through a variety of web browsers, such as Google Chrome and Mozilla Firefox, among others.

In the following sections, we will delve into the platform’s robust and cutting-edge features, exploring its benefits comprehensively. Additionally, we will provide insights into the process of opening an account to leverage this version of the trading platform. The advantages of utilizing this platform will be discussed in detail, along with a brief overview of the pricing structure.

Upstox Pro Web – Top Features

Unveiling the Abundance of Stock Trading Features in Upstox Pro Web

When delving into the realm of stock trading features, Upstox Pro Web emerges as a treasure trove of functionalities. Ranging from specialized options to essential tools, this platform embodies a comprehensive suite of capabilities that are both diverse and impactful. While it’s impossible to encompass every facet, here’s a compilation of some of the most prominent and recognizable features.

Upstox Pro Web stands as an HTML-based web trading platform, seamlessly compatible with contemporary web browsers like Google Chrome, Mozilla Firefox, Web Safari, and others. This compatibility ensures accessibility across multiple platforms.

The platform’s dynamic charting tools are not just visually striking but also informative, providing essential insights into the stock market. It captures the essence of rapidly evolving market trends and proposes viable solutions to critical challenges.

Featuring an extensive array of over 100 indicators, Upstox Web Trading Platform empowers users to tailor their charts precisely to their preferences, enhancing customization.

A hallmark of the platform is its facilitation of swift stock transactions, enabling seamless buying and selling activities.

Beyond the basics, the platform introduces advanced functionalities such as bracket orders and cover orders, constituting a part of its Pro Order Placing feature set.

Embracing the fast-paced nature of trading, the One-Click Trade option equips traders to swiftly engage in transactions, particularly beneficial during high market volatility.

The platform’s user interface is a work of art, seamlessly blending aesthetics with functionality, resulting in a visually pleasing and intuitively organized layout.

Personalization takes center stage, allowing users to tailor their entire account according to their preferences and requirements.

Providing unwavering support, Upstox extends its customer care services 24/7, ensuring that assistance is readily available whenever needed.

In summation, Upstox Pro Web redefines the stock trading experience by encompassing a plethora of features that cater to diverse trading needs and preferences.

How to Establish Your Upstox Online Trading Account?

Setting up the Upstox Pro Web trading platform is a straightforward process that involves the following steps:

- Start by visiting the official Upstox website.

- Locate the “Sign in” option situated at the top of the webpage and click on it.

- Choose “Pro Web” from the menu. On the subsequent page, log in to your Upstox Pro Web account.

- Proceed to request your account’s Login ID and Password from an Upstox representative. It’s important to note that access to this platform requires you to be a regular Upstox client. Further instructions on platform usage will be provided.

- Once you receive your login credentials, securely log in to your account. For enhanced security, consider changing your password regularly.

- With successful login, your Upstox Pro Web account is now operational, enabling you to initiate trading.

Steps to Acquire Upstox Pro Web:

- It’s evident that Upstox Web Trading serves as a capable trading platform. However, prior to delving into ownership details, it’s essential to understand that obtaining a Demat account is the initial requirement. This exclusive Upstox Demat account is offered by the parent company.

- For engaging in stock trading via this platform, possessing an Upstox account is obligatory. An account opening fee of ₹150 is applicable upfront; this is a one-time charge.

- Subsequently, a transaction fee of ₹20 is applicable for each executed order. As far as our knowledge extends, there are no additional fees involved.

Guidelines for Utilizing Upstox Pro Web

- The process commences by filling up the form on the sidebar of this article and choose the “Demat Account” option before submitting the form.

- A straightforward contact form awaits completion, necessitating your name, contact number, and city. Expect a callback from an Upstox representative.

- Identity verification and KYC formalities will be concluded by the representatives. Submission of relevant documents and payment of ₹150 for account opening, along with a request for a Trading account, will be part of this process.

- Once your KYC documents are verified, typically within 1-2 days, you will receive login credentials to access your account.

- Subsequently, follow the comprehensive Upstox Pro Web setup procedure to activate your account and initiate trading.

Advantages of the Upstox Web Trading Platform

After grasping the features, it becomes evident that the Upstox Online Trading Platform boasts remarkable competence. Familiarize yourself with the primary advantages of utilizing this exceptional platform:

- Multiple watch lists at your disposal.

- Generation of recommendation lists aligned with current market conditions.

- User-friendly interface enhancing the trading experience.

- Access to real-time stock market updates.

- Seamless synchronization across various platforms.

- Personalized company news checks.

- A platform designed to cater to new clients.

- Round-the-clock stock trading from any location.

- Minimum Demat account opening fee.

- Enhanced trading decisions through Technical Analysis tools.

- Exceptional customer care and issue resolution services.

- Assured secure and safe stock trading via Upstox Pro Web.

- Compatibility with various web browsers including Google Chrome, Internet Explorer, Mozilla Firefox, and Web Safari.

Upstox Pro Web – Conclusion

With a comprehensive understanding of Upstox Pro Web, it’s clear that this trading platform boasts significant competency within the market. It encompasses all essential features for facilitating effortless stock trading.

Attention to security and compatibility aspects makes Upstox an ideal choice for new clients entering the stock trading realm with limited experience. It’s evident that discount stockbrokers like Upstox prioritize the latest technological advancements demanded by the industry. This commitment is apparent in their offered trading platforms.

Undoubtedly, the Upstox Online Trading Platform stands as a commendable initiative poised to unlock new possibilities. Its popularity underscores its success and impact within the market.

IIFL Trader Terminal – Review, Features, Benefits, Set-up Process & more

In this article, we are set to conduct an in-depth evaluation of the IIFL Trader Terminal, recognized as one of the premier trading platforms within the country. Our exploration will delve into its extensive range of features, the process of its setup, advantages, disadvantages, and more.

Let’s embark on an exhaustive analysis of the IIFL Trading Terminal – Trading Platform as follows:

Introduction to IIFL Trader Terminal

Amidst the array of trading platforms available in the market, the IIFL Trader Terminal stands out as a particularly advantageous option. Renowned for its comprehensive capabilities, this trading tool is seamlessly integrated with advanced charting and analytical functions.

The market boasts several versions of this platform, with the latest iteration sporting a world-class user interface. This version excels in providing a singular, lightning-fast execution speed while ensuring swift access to global markets.

Moreover, the platform extends a diverse array of functionalities, facilitating trading across various domains including cash, derivatives, commodities, mutual funds, IPOs, currencies, and much more.

Essentially, the platform designates four distinct sectors for trading:

- National Stock Exchange (NSE)

- Bombay Stock Exchange (BSE)

- Multi Commodity Exchange (MCX)

- National Commodity and Derivatives Exchange (NCDEX)

Key Highlights of IIFL Trader Terminal’s Appealing Attributes

The IIFL Trader Terminal boasts an array of features that serve to enhance comprehension of its operations and provide compelling incentives for its utilization. Take a closer look at these notable features:

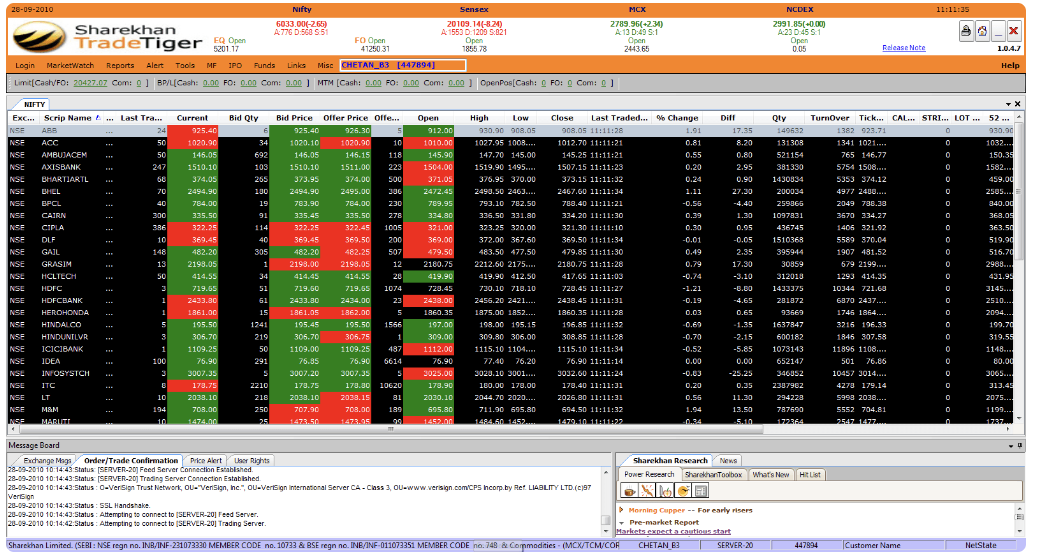

1. Comprehensive Market Insights

The Market Watch function emerges as a pivotal window, furnishing users with a valuable vantage point to access information pertaining to diverse local and global markets. This feature proves particularly advantageous for investors, offering them the ability to observe pre-selected scripts that align with their interests.

2. Multi-faceted Market Observation

This platform empowers users to generate and open distinct Market Watch windows, facilitating a concurrent and real-time overview of script specifics within preferred sectors or scrips. By enabling the creation of multiple windows, users can seamlessly monitor their chosen segments in real time.

3. Tailored Stock Selection

By facilitating the selection of stocks from both a predefined list and personalized collections, the platform accommodates users’ unique trading preferences. This flexibility empowers users to effectively manage and execute trades using either pre-established or self-curated lists of stocks.

Creating a Market Watch:

- Navigate to Market > Market Watch > New or simply press F4 on the display.

- To load a pre-configured Market Watch, right-click on the screen and opt for Load Group.

- Select the Predefined option, indicated by the + sign.

- Double-click on the desired choice to promptly unveil the Market Watch.

Incorporating Scrips into the Market Watch:

- Access the Add Scrip feature.

- Input the scrip’s name in the Code/Symbol field.

- Press the Enter key to confirm.

- Witness the scrip seamlessly integrate into the Market Watch, consequently safeguarding your configuration.

- For safekeeping, press Ctrl-S to save your personalized Market Watch, assigning it a distinctive name.

Key Market Watch Tips:

1. Organize Saved Market Watch Files: To maintain a well-organized setup, consider exporting your saved market watch file to a designated folder on your computer. This can be achieved by right-clicking on the Market Watch and selecting the “Export Scrip List” option. Each row in this exported data holds essential information such as script name, last traded quantity, best bid rate, last traded price, best offer rate, total volume, and more.

2. Explore Market Depth: Among the standout features of IIFL Trading Software is the Market Depth functionality. This provides you with valuable insights, including real-time scrip details, the top 5 Bid/Ask values, Open Interest, as well as the Daily Price Range encompassing the 52 Week High and Low. Additionally, you can access the Average Traded Price (ATP). Accessing Market Depth is as simple as double-clicking on the desired scrip within your Market Watch.

3. Utilize the Market Analyzer: Another notable tool at your disposal is the Market Analyzer. This feature offers a comprehensive snapshot of the current market conditions, giving you a clear understanding of the ongoing situation.

4. Effortless Single-Click Order Placement: One of the most thrilling capabilities is the option to place orders with a single click. This streamlined process enhances efficiency and agility in executing trades.

5. Enhanced Security through Authentications: To bolster security, the software incorporates a two-level authentication process. This added layer of protection ensures a more secure trading environment.

6. Manage Multiple Market Watch-Lists: Consider creating and maintaining multiple market watch-lists. This strategic approach allows each customer to monitor pertinent information on pre-selected scripts effectively.

Key Features of IIFL Trading Terminal:

- Comprehensive Market Information: Gain access to multiple market watches, real-time streaming quotes, and instant order confirmation.

- Convenient Financial Insights: Enjoy free access to single-click entry into the depository, ledger, and MTM profit/loss statement.

- Advanced Charting and Analysis: Utilize advanced charting options and technical analysis tools for enhanced trading decisions.

- Customizable Interface: Experience a highly customizable viewing interface tailored to your preferences.

- Direct Communication: Professionals can engage in live chat with customer care for immediate assistance.

- Up-to-date Research: Stay informed with the latest updates and real-time results from ongoing research.

Setting up the IIFL Trading Platform:

To access the platform, follow these simple steps:

- Download the Application: Visit the IIFL website for the IIFL Trading Terminal download link.

- Installation: Install the application by following the step-by-step instructions, designed for Windows systems.

- Login: Use your login ID and password to log into the platform.

- Completion: Your setup process will be complete. If you encounter any issues, contact your Relationship Manager (RM) for resolution.

Requirements for Using IIFL Trader Terminal:

Ensure the following on your PC:

- Operating System: Compatible with Windows 98, 2000, 2003, NT, XP, Vista, and 7 (excluding Windows 2000, NT, and 98).

- Proxy Settings: Open ports if accessing the software from behind a proxy.

- Browser Version: Supported by popular browsers like IE 6/IE 7, Mozilla, and Chrome.

- .NET Version: Requires .NET VERSION 4.0.

Ownership of IIFL Trader Terminal:

Acquire the IIFL trader terminal for free with the demat and trading account upon signing up with IIFL. Once registered, you’ll receive a login ID and password for access.

Advantages of IIFL Trading Terminal:

Experience the following benefits:

- Real-time Live Chat: Engage with customer care during market hours for real-time assistance.

- Comprehensive Reports: Access fundamental and technical analysis reports within the trading application.

- Informative Reports: Gain insights from daily (‘Market Mantra’) and weekly (‘Weekly Wrap’) reports.

- Flexible Order Placement: Place orders and use After Market Orders (AMO) for the next business day.

- Custom Alerts: Set up personalized alerts based on preferred scrips and conditions.

- Live TV Access: Enjoy LIVE TV coverage for market insights.

- Security Feature: The automatic LOCK feature activates after 10 minutes of inactivity.

- Fund Transfers: Conveniently transfer funds through various options.

- Order Management: Manage orders, cancellations, open positions, and more.

Disadvantages of IIFL Trading Software:

Consider the following limitations:

- Platform Compatibility: Limited to Windows users; not available for iOS users.

- Activation Process: Future segment or option segment trading requires written applications and income proofs.

Conclusion – IIFL Trader Terminal:

Considering the detailed overview, we recommend using the IIFL Trading Terminal for an enriched experience. With an IIFL trading account, access cutting-edge trading platforms, real-time market updates, alerts, IPO information, and NFO details. Subscribe now to leverage the platform’s world-class features and enhance your trading endeavors.

Top Trading Terminals

Sharekhan Trade Tiger

Published

2 years agoon

September 4, 2023By

Ajit Singh

Sharekhan Trade Tiger – Review, Top Features, Benefits, Set-up & more

Sharekhan’s Trade Tiger stands as a premier trading terminal within the stock market domain, meriting an in-depth review.

Sharekhan, a prominent trading platform in India, presently under the ownership of BNP Paribas, was established in 2000. Operating with a widespread presence across the nation, the company has expanded its services to the online sphere. They facilitate trading across diverse platforms while also offering educational resources to aid traders.

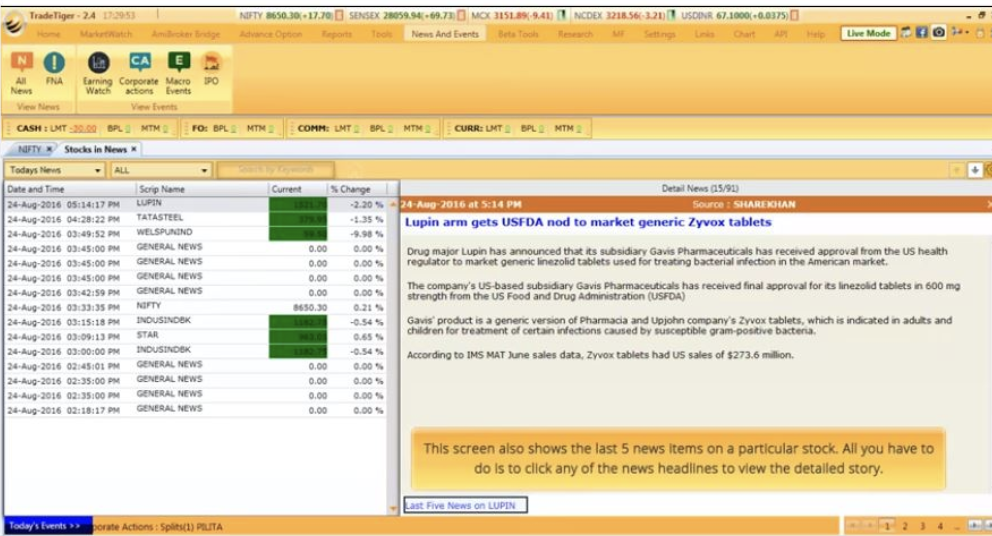

Of notable favor among their clientele is the market updates feature, complemented by intriguing offerings such as the NEO robot and Sharekhan TV, both accessible online. However, the spotlight shines on their flagship product, Trade Tiger, which greatly simplifies online trading.

Insight into Sharekhan Trade Tiger Software

Emerging as a key player in the stock broking domain, Sharekhan introduced the maiden version of its trading terminal software, Sharekhan Trade Tiger 1.0, in 2007. This marked a pivotal step towards digitalizing their trading platform, extending their reach to a broader audience.

The trade tiger software was met with positive reception from the public, providing a robust suite of features catering to seasoned stock traders. The software encompasses a spectrum of functionalities, from chart linking to chart books, and beyond.

Distinguishing itself with its prowess, Sharekhan’s trading terminal offers remarkable market scanning capabilities, exemplified by heat maps and stock scanners. These tools empower investors to identify and assess prospective stocks for investment. Furthermore, the software streamlines trading activities, enabling the execution of bulk orders with a single click.

Sharekhan Trade Tiger Trading Platform – Top Features

Introducing Sharekhan Trade Tiger Software, a stalwart in the market for over a decade. Continuously refined, the Trade Tiger Terminal consistently integrates new market dimensions. Here are the standout attributes that have elevated it into an exceptional platform:

Swift and Dependable Data Streams

Often, the reliability of online data feeds is questionable. The essence of frequent updates for optimal outcomes is encapsulated within Trade Tiger Software. Accessible at any time, it ensures premium data feeds.

Multi-Exchange Capability

Diversifying trading possibilities, Trade Tiger Software facilitates concurrent usage of multiple exchange platforms. Empowering clients to seamlessly transact stocks and predict market performances.

Exemplary Charting

A fundamental facet of any trading platform, Sharekhan Trade Tiger simplifies and enriches charting. Crafted for both simplicity and effectiveness, it boasts advanced tools and analyses tailored for professional traders.

Advanced Tools and Order Features

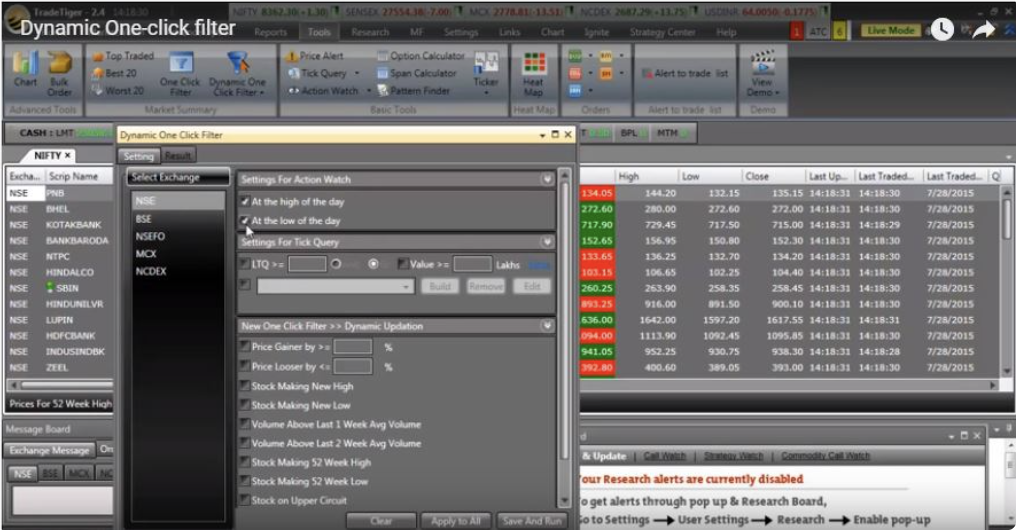

Navigating the complexities of trading demands adept tools. Advanced Tools encompass Live Market Scanner and Heat Maps, aligning professional traders with their opportunities. Meanwhile, the Advance Order feature instills discipline, optimizing returns and easing processes like Bulk Order and Big Trade.

Guided Online Training

Recognizing diverse proficiencies, Trade Tiger Software offers comprehensive training. Equipping users to harness the software’s potential, enhancing their prowess in online trading.

Responsive Online Support

In the realm of online trading, robust support is indispensable. Trade Tiger Software prioritizes assistance, enabling users to promptly resolve issues via direct contact.

Highlights of the Latest Version

Sharekhan Trade Tiger recently unveiled an updated version brimming with advanced options for seasoned traders. Notable inclusions encompass Trade from MS Excel, Advanced Option Chain, AmiBroker Trading Bridge, Stock Scanner, and API Integration.

An Overview of Sharekhan Trade Tiger

An encompassing evaluation of Sharekhan Trade Tiger reveals a minimalistic yet highly beneficial platform for traders. Its omnipresence on laptops, requiring a mere internet connection, streamlines the trading experience.

Procuring and Installing Trade Tiger Software

Trade Tiger stands prominently within Sharekhan’s product portfolio. Visitors can conveniently download the software or explore a demo on the dedicated page. Bundled with Sharekhan’s Trading Account, it enhances online trading with market-savvy insights and techniques.

Choice in Versions

Opting for either the Basic or Advanced version of Trade Tiger, users experience the convenience of daily operation with consistent internet connectivity. Detailed information is available in the download section of Sharekhan’s resources.

How to Set up Sharekhan Trading Terminal?

Sharekhan Trade Tiger is available in two distinct versions for download. You have the option to download either Trade Tiger Basic or the more advanced Trade Tiger software. The advanced version boasts heightened features but comes with higher RAM prerequisites. Both versions can be downloaded and installed onto your system free of charge.

For Trade Tiger Basic, a minimum of a Pentium 4 processor and 1 GB of RAM are essential. Conversely, Trade Tiger Advanced necessitates a Pentium dual-core processor or higher and 2 GB of RAM.

Moreover, the advanced iteration mandates 1 GB of disk space for installation, while the basic version requires a mere 40 MB. To ensure seamless performance, select the version of Trade Tiger that aligns with your computer’s specifications.

To initiate the installation process of Sharekhan Trade Tiger on your system, adhere to these steps:

- Visit the official Sharekhan website (Sharekhan.com).

- Hover your cursor over the Products and Services tab at the top right corner.

- From the drop-down menu, navigate to Sharekhan Trading Software under the Platforms category.

- On the ensuing page, click the download button.

- Choose between Sharekhan Trade Tiger Basic or Advanced, based on your system specifications.

- Opt for the 32-bit download link if your computer is 32-bit, otherwise select the 64-bit option, and initiate the download of the setup file.

- After the setup file is downloaded, execute it and follow the indicated steps to install Sharekhan Trade Tiger Software on your system.

Acquiring Sharekhan Trade Tiger Software Ownership:

As previously indicated, to access the comprehensive range of Sharekhan trade tiger software features, you must create an online account with Sharekhan.

In the upcoming section, we will elaborate on the procedure for establishing a Sharekhan account. To initiate the process of setting up an online Sharekhan account, adhere to the subsequent steps:

- Fill up the form on the sidebar of this article and choose the “Demat Account” option before submitting the form.

- Complete the displayed pop-up form with your information and submit it.

- Anticipate a call from Sharekhan’s representatives.

- These representatives will guide you through the online Demat Account initiation process.

- After the account is successfully created, you will receive a client ID and password.

- Utilize these login credentials to access the Sharekhan Trade Tiger Software, enabling you to explore all the functionalities it offers.

Advantages of Sharekhan Trading Software

Experience the Benefits of Sharekhan Trade Tiger:

1. Seamlessly Trade Currency Options: Enjoy the convenience of trading currency options on both the National Stock Exchange (NSE) and the Multi Commodity Exchange (MCX) without encountering any hindrances or limitations.

2. Advanced Order Placement: Take advantage of advanced order types such as bracket orders and trailing stop loss orders on the National Stock Exchange Cash and Bombay Stock Exchange Cash for Bigtrade products.

3. Effortless Bracket Order Execution: Execute bracket orders swiftly at market rates using the intuitive Sharekhan Trade Tiger Software.

4. Empowering Research Section: Leverage the software’s integrated research section to identify promising emerging stocks and seize early investment opportunities.

5. Comprehensive Trading Tools: Access a suite of advanced trading tools, including the Dynamic Oneclick Filter, Oneclick Filter, Stock Scanner, and Heatmap. These tools provide invaluable insights for making well-informed decisions about potential investments.

In Conclusion:

Sharekhan, a prominent brokerage firm in India, stands as the third largest in terms of customer base. The Sharekhan Trade Tiger software, their proprietary trading terminal, offers a robust array of features. Designed for Windows computers, this feature-rich software includes tools like Heatmaps and Stock Scanner, empowering traders to analyze and predict stock performance for informed investment choices.

For those engaged in the stock market, an exploration of the Sharekhan Trade Platform is highly recommended. Embark on this trading journey to unlock a world of possibilities.

Trending

-

Broker Reviews2 years ago

Broker Reviews2 years agoCompare Brokers

-

Broker Reviews2 years ago

Broker Reviews2 years agoBest of Stock Brokers in India

-

Authorised Person2 years ago

Authorised Person2 years agoAuthorised Person Registration

-

Vastu Shastra7 months ago

Vastu Shastra7 months agoVastu Tips to Enhance the Success Ratio in Broking & Wealth Business

-

Broker Reviews2 years ago

Broker Reviews2 years agoDiscount Broker Review

-

Franchise2 years ago

Franchise2 years agoFranchise Offers

-

Demat2 years ago

Demat2 years agoDemat

-

Demat2 years ago

Demat2 years agoZerodha Demat Account